The new borrower-focused guide from Low Credit Finance outlines how no credit check loans work, who qualifies, and what to expect during the U.S. application process.

Dallas, June 28, 2025 (GLOBE NEWSWIRE) —

If you’re looking for a loan without a credit check, look no further. We have found the best no credit check loans, with Low Credit Finance being our number one pick for meeting all the criteria.

If you’re currently looking to secure a no credit check loan but are having a hard time identifying the best lender, you’re not alone. At times, it can be difficult to settle on the best deal that will adequately sort out your current financial situation, given the number of no credit check loan lenders available in the U.S.

To help you make an informed decision, our team has carefully researched the U.S. lending market and identified the best lenders who offer no credit check loans for those with a poor credit score or no credit history at all.

Recommended No Credit Check Loans

- Low Credit Finance – Transparent no credit check loan transactions.

All the above-listed brokers have a wide range of lending networks that are willing to extend instant no credit check loans.

To learn more about each of these companies, read on for the full overview.

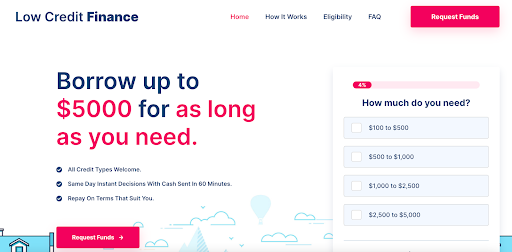

- Low Credit Finance: Transparent no credit check loans

If you’re looking for a transparent lender for a no credit check loan, consider Low Credit Finance. By prioritizing transparency in the total cost of their loans, Low Credit Finance ensures that there are neither hidden nor extra charges, keeping your total loan costs minimal.

To maintain affordability, Low Credit Finance offers no credit check loans with competitive interest rates and flexible repayment terms tailored to your needs. This commitment to borrower-friendly terms stems from its experienced team of professionals adept at providing no credit check loans to subprime borrowers.

In essence, Low Credit Finance serves as a dependable platform, granting access to no credit check loans up to $5,000 under favorable conditions. With their streamlined online application process, you can expect your approved funds to be deposited into your bank account within 60 minutes of approval.

Why Low Credit Finance?

- It has transparent transactions.

- No extra charges.

- It charges affordable interest rates on no credit check loans.

- It offers easy and convenient online application processes.

- It has flexible repayment periods on no credit check loans.

Eligibility Requirements of No Credit Check Loans in the U.S.

Just like conventional loans offered by traditional financial institutions, no credit check loans come with their own set of eligibility criteria that must be satisfied before approval is made. In this segment, we have outlined the requirements that you need to meet to secure approval:

- Age requirement – 18 years and above.

- Citizenship or residency – You need to be a US citizen or a permanent resident.

- Income – You must provide evidence of a verifiable source of income.

- Debt-to-income ratio – You must maintain a favorable debt-to-income ratio.

- Bank account – You should possess an active bank account.

- Contact information – You must provide valid contact information, an email address, and/or phone number.

Meeting these eligibility criteria is crucial when applying for no credit check loans, much like it is for traditional loans. However, fulfilling these requirements for no credit check loans is easier. For this reason, many applicants have their approvals passed, as meeting the above greatly enhances the chances of approval.

If you meet the above criteria for getting a no credit check loan, the process for applying for one is below.

Application Process for a No Credit Check Loan

Here are the steps you should follow to apply for a no credit check loan:

- Select a lender – Start by choosing a no credit check loan lender from our list.

- Visit the lender’s website – Once you’ve identified a suitable lender, visit their website to access their loan application platform.

- Complete the application form – Fill out the application form provided by the lender. You’ll need to provide personal and financial information.

- Await application results – After submitting your application, await the lender’s response.

- Accept the loan terms – If your application is approved, carefully verify the loan terms and conditions presented by the lender. Ensure that you fully understand the terms before proceeding.

- Funds deposit – Upon accepting the loan terms, the lender will deposit the approved loan amount directly into your designated bank account.

As can be seen above, applying for a no credit check loan is straightforward and conveniently completed online. Should you require any assistance or have questions, the recommended lenders we provide can offer guidance and support throughout the application process.

Factors to Consider When Shopping for No Credit Check Loans

No credit check loans are a plausible choice not only for individuals with bad credit but also for those with prime credit scores, as they provide quick access to cash. This, therefore, makes them a go-to financial option for many, and as a result, it is vital to consider the following aspects as you shop for a no credit check loan lender. They include:

- Interest rate – No credit check loans often have relatively higher interest rates than other types of loans. However, you should compare the annual percentage rate (APR) of the different no credit check loan lenders and choose the one that offers the lowest rate for your loan amount and term.

- Fees and charges – Some no credit check loan lenders may have hidden fees that can increase the cost of borrowing. These extra costs could come in the form of origination fees, late payment fees, prepayment penalties, or other fees that may not be disclosed upfront. You should therefore read the loan agreement carefully and seek clarification on any that may not be clear.

- Repayment terms – You should look for a no credit check loan with a repayment term that suits your financial abilities. This is because no credit check loans usually have shorter repayment terms, meaning you have to pay back the loan faster. Thus, taking on a loan with repayment terms that are not suitable may end up putting a strain on your budget and making it harder to meet your other financial obligations.

- Approval rate – When looking for a no credit loan lender, you should consider one with a high approval rate as it suggests that the lender is more lenient with its eligibility criteria. This may suggest its specialization in working with individuals with less-than-perfect credit as well as a high likelihood of having your financial crisis handled.

- Customer support – When looking for a no credit check loan, good customer support is essential for addressing inquiries, clarifying doubts, and resolving issues related to your loan. A lender’s customer support evaluation can be done by going through the reviews and customer feedback.

As for our recommended no credit check loan lenders, you can rest assured that all the above aspects were considered.

Tips for Responsible Borrowing of No Credit Check Loans

Only Borrow What You Need

When you borrow a no credit check loan, it is wise to limit the amount to cover your specific financial needs. Borrowing only what you need not only minimizes the overall debt burden but also reduces the risk of overextending your finances.

Borrow from Reputable Sources

Borrowing from reputable sources entails selecting no credit check loan lenders with a proven track record of fair and transparent lending practices. You should check that the no credit check lender of your choice adheres to industry regulations, provides clear loan terms, and protects borrowers’ rights to ensure that you receive fair treatment.

Set a Clear Repayment Plan

Having a clear repayment plan for your no credit check loan involves outlining how you will repay the borrowed funds. The plan could include the monthly installment amount, due dates, and total repayment period. This helps you budget effectively and ensures that you make timely payments, reducing the risk of late fees or default.

Monitor Finances

Monitoring your finances entails regularly reviewing your income, expenses, savings, and debt obligations to help you stay aware of your financial health. As such, you can make necessary adjustments to your budget and track your progress in repaying your no credit check loan.

Avoid Multiple Loans

By avoiding multiple no credit check loans, you are in a much better position to manage the payments and keep track of the timelines. As managing multiple loans is complex and increases the risk of missing payments, it is advisable to focus on paying off one loan before considering another.

Conclusion

In the complex world of personal finance, where your credit history often determines your financial path, no credit check loans stand out as a way out for those facing tough times. These loans don’t care about your credit score as they transcend the traditional barriers erected by credit histories, offering a chance at financial stability and security.

However, just like any other financial tool, you need to use them carefully lest they be your undoing financially. By taking into consideration the factors that we have highlighted, you can use no credit check loans smartly and to your advantage. So, as you go on your financial journey, remember that these loans can help you overcome money problems and look forward to a better future.

Frequently Asked Questions

What happens if I can’t repay a no credit check loan?

If you’re unable to repay the loan, contact your lender immediately to discuss your options. Depending on the lender’s policies, you may be able to arrange an alternative repayment plan or extension. Defaulting can lead to additional fees and collection efforts.

Can I apply for a no credit check loan if I have a low income?

Your income is a crucial factor in loan approval. While some lenders may consider low-income applicants, you must demonstrate your ability to repay the loan within the specified terms.

Are there limits to how I can use the money from a no credit check loan?

Generally, no. You can use the loan funds for various purposes, such as medical bills, car repairs, debt consolidation, or even a vacation. However, it’s advisable to use the funds for necessary expenses and financial goals.

- Email Support: [email protected]

- Phone Number: 1-844-870-5672

Disclaimer and Disclosure

The information presented in this release is for general informational purposes only and does not constitute professional financial advice, legal counsel, or loan approval guarantees. While every effort has been made to ensure accuracy, completeness, and timeliness, no representations or warranties, express or implied, are made regarding the content. In the event of any errors, omissions, or outdated details, neither the publisher, the issuing party, nor any affiliated syndication partners shall be held liable for damages or losses of any kind.

Readers are strongly encouraged to conduct their own due diligence, consult with licensed financial professionals, and verify any details directly with the third-party services referenced before making financial decisions. Loan terms, eligibility criteria, and approval timelines may vary by provider and jurisdiction, and are subject to change without notice.

This release may include affiliate links, which means the publisher or associated parties may receive compensation if a reader clicks through and completes a qualifying action with a linked third-party lender. Such compensation does not influence the objectivity or integrity of the information presented. All opinions remain those of the original issuing party and do not reflect endorsements by the publisher or any downstream media outlets.

This content is distributed as-is and without warranties of any kind. All responsibility for product claims, representations, or factual accuracy lies solely with the issuing organization. Syndication partners and distribution services assume no responsibility for the accuracy or legality of the information contained herein.

CONTACT: Email Support: [email protected] Phone Number: 1-844-870-5672